Mortgage Broker San Francisco: Helping You Understand Different Loan Programs Available

Mortgage Broker San Francisco: Helping You Understand Different Loan Programs Available

Blog Article

Discover the Value of Hiring an Expert Mortgage Broker for Your Home Acquisition

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Know-how in Home Mortgage Alternatives

Browsing the facility landscape of home mortgage alternatives calls for not just expertise yet additionally a nuanced understanding of the monetary market. An expert home loan broker brings necessary competence that can substantially boost the home-buying experience. These professionals are fluent in the myriad kinds of mortgage products readily available, consisting of fixed-rate, adjustable-rate, and specialized financings like FHA or VA home mortgages. Their detailed understanding enables them to identify the most effective services tailored to specific monetary circumstances.

In addition, home loan brokers remain updated on dominating market patterns and rates of interest, enabling them to give educated recommendations. They can examine clients' economic profiles and help in determining qualification, calculating possible monthly settlements, and comparing general prices connected with numerous home loan items. This degree of insight can be vital, particularly for new homebuyers that might feel overloaded by the alternatives available.

In enhancement, a home mortgage broker can help clients navigate the details of lending terms, charges, and prospective challenges, ensuring that borrowers make knowledgeable decisions. By leveraging their know-how, buyers enhance their chances of securing beneficial home loan conditions, inevitably causing a more successful and economically sound home purchase.

Access to Multiple Lenders

Access to multiple lending institutions is just one of the vital benefits of dealing with a specialist home loan broker. Unlike private customers who may just take into consideration a minimal number of lending alternatives, home loan brokers have actually developed connections with a large array of loan providers, consisting of banks, cooperative credit union, and alternative funding sources. This comprehensive network allows brokers to access a varied variety of funding products and passion prices tailored to the details demands of their clients.

By presenting several financing alternatives, home loan brokers empower consumers to make educated decisions. They can contrast various terms, passion rates, and repayment strategies, guaranteeing that customers discover the best suitable for their financial circumstance. This is particularly valuable in a changing market where conditions can vary significantly from one loan provider to another.

Additionally, brokers frequently have insights right into unique programs and rewards that might not be widely marketed. This can lead to prospective financial savings and much better loan conditions for consumers, ultimately making the home buying procedure much more reliable and cost-effective. In summary, access to several lending institutions through an expert home mortgage broker enhances the borrowing experience by supplying a bigger selection of financing choices and cultivating informed decision-making.

Personalized Financial Assistance

An expert home mortgage broker gives personalized monetary support that is customized to the specific demands and circumstances of each customer. By examining a customer's economic scenario, including earnings, credit report, and long-lasting objectives, a broker can supply understandings and referrals that straighten with the consumer's unique profile. This bespoke approach ensures that clients are not just presented with generic alternatives, yet instead with customized home mortgage options that fit their certain demands.

Additionally, brokers have comprehensive knowledge of different funding items and existing market trends, enabling them to enlighten customers regarding the benefits and downsides of various funding options. This assistance is critical for customers that might feel overwhelmed by the complexity of home loan selections.

Along with browsing via various financing standards, a home loan broker can help customers recognize the effects of different loan terms, prices, and connected costs - mortgage broker san Francisco. This quality is vital in equipping consumers to make educated decisions that can dramatically affect their financial future. Ultimately, personalized financial advice from a home mortgage broker news cultivates confidence and comfort, making certain that clients really feel supported throughout the home-buying procedure

Time and Price Cost Savings

In addition to providing tailored financial advice, an expert home mortgage broker can considerably conserve clients both time and cash throughout the mortgage process. Browsing the complexities of home loan choices can be frustrating, particularly article source for newbie homebuyers. A proficient broker streamlines this process by leveraging their sector knowledge and connections to recognize the most effective home loan items readily available.

In addition, brokers can help customers avoid pricey mistakes, such as picking the wrong home loan type or ignoring hidden charges. Overall, utilizing a specialist home loan broker is a sensible investment that equates to substantial time and financial benefits for homebuyers.

Stress And Anxiety Decrease During Process

Just how can homebuyers navigate the usually stressful trip of getting a mortgage with higher convenience? Engaging an expert home loan broker can significantly minimize this anxiousness. These experts understand the complexities of the home mortgage landscape and can guide buyers with each phase of the procedure, making certain that they stay educated and certain in their decisions.

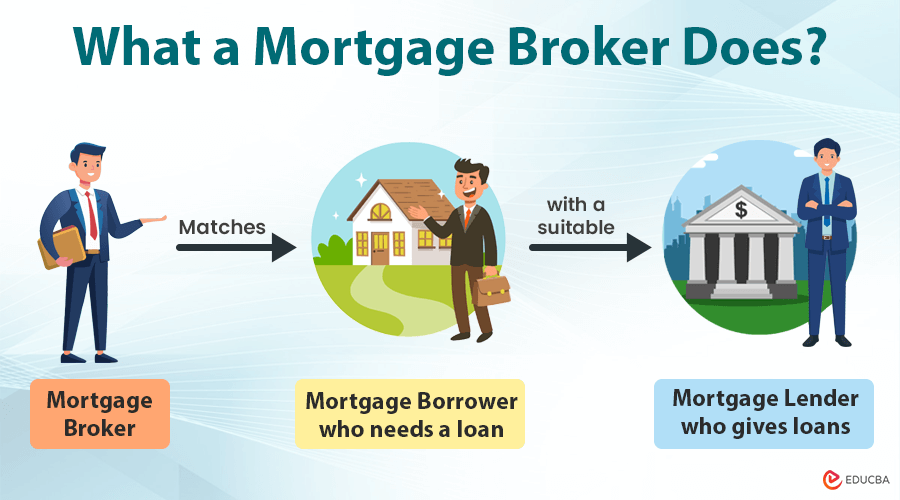

A home loan broker functions as an intermediary, streamlining interaction in between lenders and purchasers. They handle the documents and due dates, which can usually really feel frustrating. By tackling these responsibilities, brokers allow homebuyers to focus on other important aspects of their home acquisition, reducing general tension.

Furthermore, home loan brokers possess comprehensive understanding of different funding products and market conditions. This insight enables them to match customers with one of the most ideal choices, lessening the time spent sifting via improper deals. They likewise provide personalized advice, aiding customers set realistic assumptions and prevent typical mistakes.

Inevitably, working with an expert resource mortgage broker not just enhances the home loan process yet likewise enhances the homebuying experience. With specialist support, homebuyers can approach this critical monetary decision with better satisfaction, ensuring a smoother change into homeownership.

Verdict

To conclude, the advantages of working with an expert mortgage broker substantially enhance the homebuying experience. Their proficiency in home mortgage options, accessibility to multiple lending institutions, and ability to give customized economic assistance are invaluable. Moreover, the potential for time and expense financial savings, together with stress and anxiety reduction throughout the procedure, underscores the important role brokers play in assisting in educated decisions and preventing pricey mistakes. Engaging a home mortgage broker inevitably leads to a much more effective and efficient home purchase journey.

These professionals are skilled in the myriad kinds of home loan items offered, consisting of fixed-rate, adjustable-rate, and specialized finances like FHA or VA home mortgages.A specialist home mortgage broker gives personalized economic guidance that is customized to the specific demands and conditions of each debtor. Eventually, customized financial assistance from a home mortgage broker fosters self-confidence and tranquility of mind, ensuring that customers really feel supported throughout the home-buying process.

In addition to giving tailored economic support, an expert mortgage broker can significantly conserve clients both time and money throughout the home mortgage procedure. In general, employing a specialist home loan broker is a prudent financial investment that converts to considerable time and financial advantages for property buyers.

Report this page